Housing Market in 2023 and Wholesale Real Estate

2022 was an unstable year for the real estate market. The pandemic created the perfect storm for historic market conditions, and even experienced investors weren’t exactly sure what was coming next. There was a lot of “I can’t say for sure, but here’s my prediction…”

There’s still a fair degree of uncertainty, like always, but we can make a pretty educated guess on where things are headed for the housing market in 2023.

HOW DID WE GET HERE?

During the pandemic, there was a surge in demand for homebuyers. This demand was driven in large part by record-low mortgage interest rates, which made it much more affordable for more people to buy a home.

Then, because of the increase in demand and homebuying activity across the country, inventory quickly went down as homes were taken off the market. This drastically drove up value – fewer homes on the market coupled with more people looking to buy led to a historic increase in home prices in the United States.

There was a plethora of buyers competing with one another, who were willing to pay well above the asking price for homes. Sellers were in a great position to make a killing on their properties and many of them did.

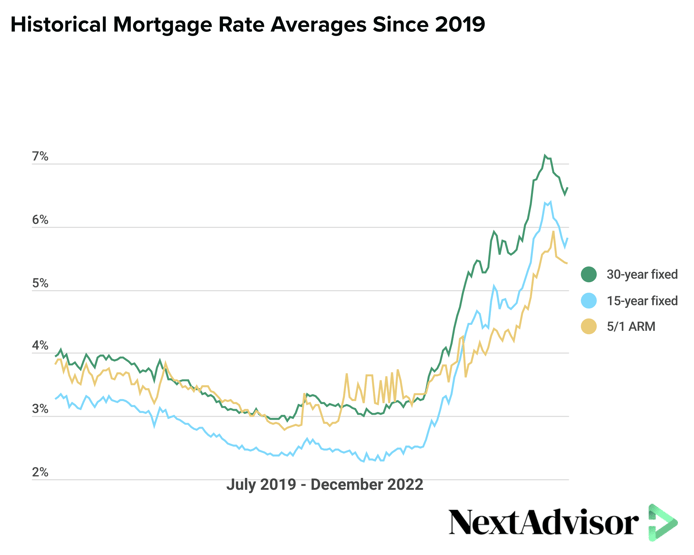

2022 is when things got a little dicey. What goes up must come down, and the Federal Reserve decided to play their part to quell housing inflation by making it harder for buyers to afford homes. They achieved this through steadily increasing interest rates and voilá. It worked. These increases priced a lot of buyers straight out of the market within a few short months and kicked into motion a decline in housing prices as demand continues to fall.

Of course, the situation isn’t quite that simple. With high inflation and world events affecting the entire global economy, there are a ton of moving pieces contributing to this market that I won’t get into here. But overall, this is the situation we find ourselves in.

WHAT YOU NEED TO KNOW

First off, the price decline isn’t nearly as bad as it might sound. It’s better termed a “deceleration”. Sure, prices may have already dropped by a few percent, but compared to pre-pandemic levels, prices are still through the roof.

According to Zillow, my home’s Zestimate (Zillow’s estimated market value for a property) saw a decline of 1.5% in the past 30 days. However, the value is still up over 30% from January 2020 – this means that sellers are still in a good position to sell at a higher price, and they can still reap the benefits of the inflated value seen during the pandemic. That being said, sellers don’t have quite the negotiating power that they enjoyed before interest rates went up.

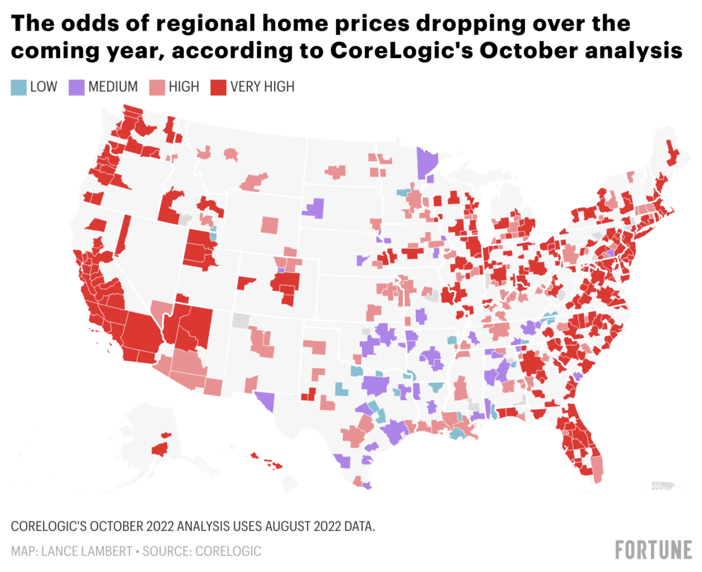

Different sources give different predictions on what’s going to happen with home prices next year, and it most likely depends on where you live. Redfin is predicting a 4% decrease in prices in 2023 across the country. According to The National Association of Realtors, prices next year won’t move definitively in either direction. Real estate agents in places such as Hartford, CT are actually predicting a rise of about 8.5%.

The situation for buyers is a little different. Interest rates are still sky-high -- pre-pandemic averages from July 2019 were between 3-4%. As of mid-December 2022, they’re sitting at 5.8-6.5%. This increased interest rate creates a pretty significant change in price for a monthly mortgage payment, so homes are less affordable on average. Also, some mortgage news sites have reported that buyers might be hesitant to purchase a home before a possible recession. This means that buyers are being more selective about which properties they buy, and houses are staying on the market for longer periods.

WHAT OTHER INVESTORS ARE SAYING

Here at DealMachine, we have an extensive network of real estate investors, some of whom have weighed in on this topic and how the changes in the market have affected their business so far. Unsurprisingly, we have seen some common themes mentioned by these investors.

One of these themes is that sellers aren’t exactly cued into how quickly the market shifted once interest rates went up, therefore they aren’t aware of how their position has changed. We hear a lot of funny stories and memes about sellers mentioning the Zestimate and expecting to get that price or higher, but that number can’t take into account the shift in buying perspective that may not have a lot of obvious indicators in the market just yet (for example average time on the market, which actually did increase during 2022).

Investors are combating this by doing more to educate the seller on the state of the market, and why the Zestimate isn’t very accurate. Breaking the numbers down clearly for someone who isn’t extremely knowledgeable is a great way to clear up any confusion during the negotiations.

According to Zach Ginn, wholesalers are in a position to make more money now than before the big market changes. The reasons for this are simple. To start, you’re not owning any real estate by wholesaling real estate, so if home value drops by something crazy like 50%, you’re not going to lose equity. Second, in a high-inflation economy with high mortgage interest rates, it’s harder to sell a home and harder to invest in renovations because of the increased material cost.

That means that sellers are going to need to lean more on wholesalers to get their homes sold in whatever condition they’re currently in. It’s also just a fact that when everything is more expensive, there is going to be more inventory in terms of distressed properties which is a wholesaler’s bread and butter.

WHAT ALL OF THIS MEANS

Based on everything we’ve covered, there are some pretty apparent conclusions that we can make. Flippers stand to take on the most risk in this market, as this avenue of investing is more heavily affected by short-term market changes like we’re seeing now. If you buy a property to flip and the project takes 6 months, there’s just more of a chance that the After Repair Value could drop during that time.

If you didn’t take into consideration these market shifts when you were initially getting into the deal, you could end up losing money or at least some of your final profits. However, if you’re “buying right” you should be able to avoid any sticky situations. Also, with the global supply chain issues, there’s a longer waiting period for getting materials like metal, wood, even windows. Projects are likely to take longer right now because of this, so keep that in mind.

Buy-and-hold investors take on less risk than flippers. There might be a potential for a short-term loss of equity or cash flow, but holding a property long-term mitigates this because you can count on the value increasing over such a long period either way. Not to mention, if you got into a mortgage with a high-interest rate, you’re going to refinance in a year or two and get a better rate when the market cools down.

These investors do however face the same risk of complications as flippers during the renovation phase. The solution for them is the same. More due diligence upfront prevents headaches and can save you from getting into a risky and problematic investment. And if you’re inexperienced and unsure about the deal, my advice is to run it by investors who have been in the game longer, and they can help you determine if it’s worth it for you.

Wholesalers are in the best position. The main foreseeable con to diving into wholesaling in a market like this is that you might profit less per deal due to a lower average ARV. But with the increased need for sellers to do business with wholesalers and more inventory of distressed properties, in all likelihood, you’ll be doing more deals than before, with 0 risks of losing equity. Less profit but more deals does mean a little extra work but is still an amazing tradeoff if you ask me, especially considering the challenges faced by investors using other strategies.

FINAL THOUGHTS

There are always going to be challenges when jumping into a new venture and this one is no exception. The good news is that a lot of the fear and apprehension stems from a lack of knowledge and the more educated you are in real estate the more confident you’ll be moving forward.

So educate yourself as much as you can, but don’t be afraid to jump in and seek help when and where you need it. And don’t forget, DealMachine’s always here to help you along the way!

About Benjy Nichols

Benjy has been a Media Manager at DealMachine for the last 5 years. He produces, writes, shoots, and edits our media content for our member's DealMachine and Real Estate education.